How do I gain insight into a bank’s

return on my portfolio?

The key concept to BRM is the return a bank makes on the capital they need to set aside for the product portfolio. Banks need to balance gross revenues versus the required capital to generate their gross revenues. Loans and guarantees have a capital requirement, transaction services do not. The underlying factor is how to optimize the ratio of gross revenues versus the required capital. This insight is central to the system.

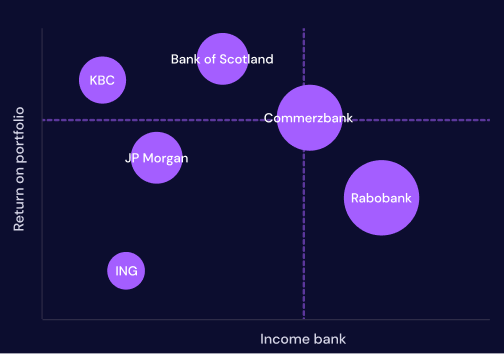

In the graph, on the horizontal axes, you can see the gross revenues generated by the bank and on the vertical axes, the return on the gross revenue. The banks in the upper right quadrant are the banks that have the highest returns and highest revenues. The banks in the lower left quadrant are the banks that have the lowest returns and the lowest revenues. This changes over time as banks can be substituted, products can shift between banks, fees and margins adjusted, and capital requirements can be adjusted due to the collateral or credit rating of the company.

The vertical dotted lines indicate the average revenue and return. The horizontal line indicates the Basel III requirement as the minimum percentage of capital over assets in scope.